Blog 19 Oct 2023

RELATED BLOGS

26 Jul 2024

7 minutes read

Deepfake in Movies | Facts, Fiction & Future of Film Industry

We witnessed Robert De Niro and Al Pacino defying...

View More

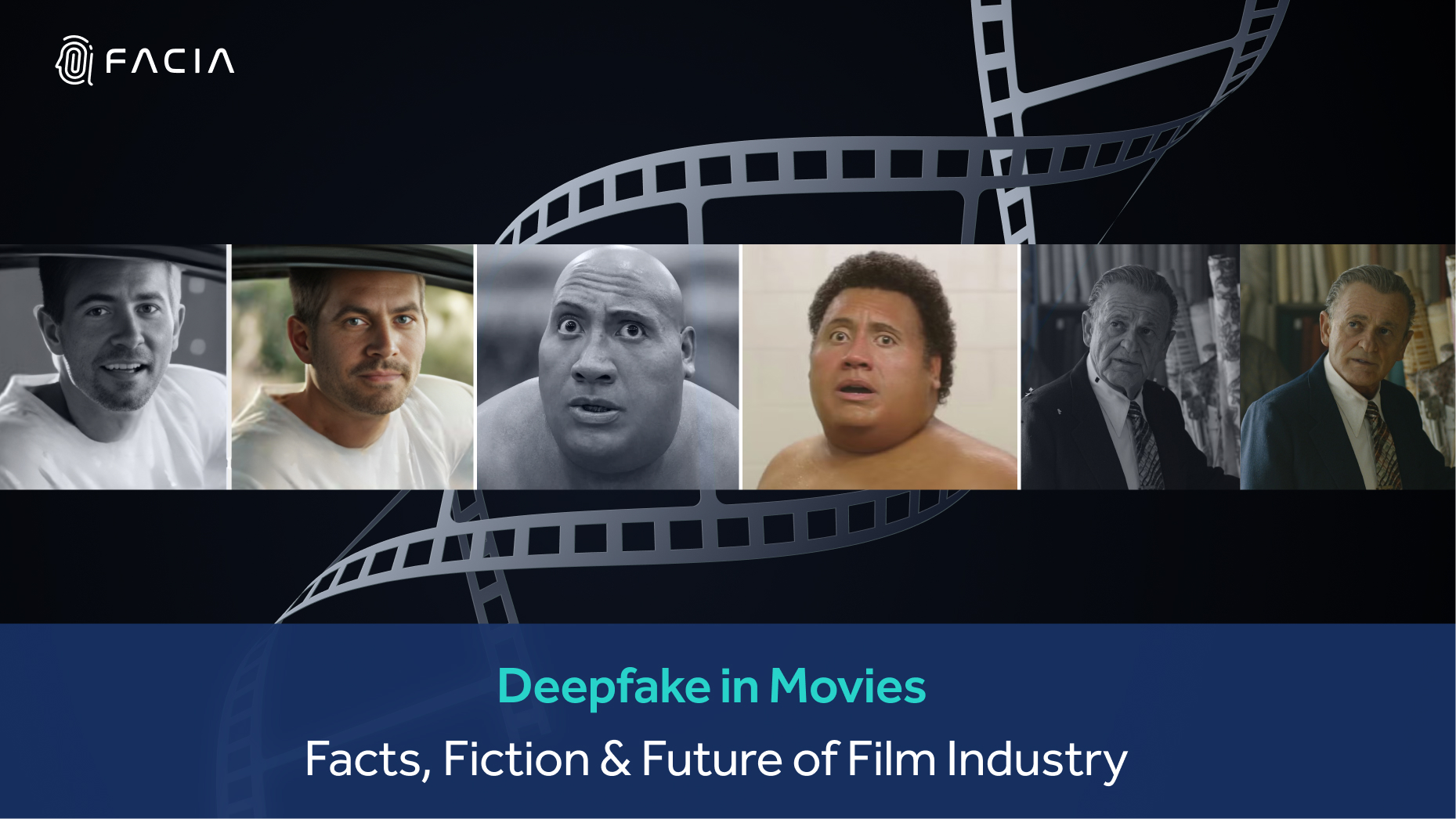

23 Jul 2024

8 minutes read

Addressing the Challenge of Partial Occlusion Detection in Facial Recognition System

People love to take pictures wearing trendy sunglasses or...

View More

20 Jul 2024

8 minutes read

Is Gait Recognition the Next Big Thing in Biometric Identity Verification?

Imagine walking towards a building where high-def cameras recognize...

View MoreSearch Blog

Search

Recent Posts